A Information To Living & Working In Japan

페이지 정보

작성자 Alphonso 작성일23-12-27 04:14 조회49회 댓글0건 연락처관련링크

본문

The standard of residing and quality of life in Japan can be believed to be certainly one of the very best on the planet. Japan's healthcare system is probably the greatest on this planet with the nation boasting some of the highest life expectancy charges. This is the general public healthcare programme which is on the market to Japanese residents and foreigners alike! Regardless of the way you withdraw the money, the tax standing of the contract determines how a lot of the withdrawal will likely be taxed. If it’s a qualified annuity, you pays taxes on the complete withdrawal quantity. Whether it is non-qualified, you pays revenue taxes on the earnings solely. Non-certified annuity withdrawals use final-in-first-out (LIFO) tax guidelines, which dictate that earnings are taxed first.

An unbiased Air Accident Investigation Bureau will be constituted. Air visitors management services and airports will probably be upgraded and modernized. My Government is taking all measures to step up the home production of oil and gasoline. The 9th round of new Exploration Licensing Policy has commenced. My Authorities is working to attach all people across the nation. In case you are from one of the 21 nations presently in agreement with the Japanese authorities, you may apply to have the sum of your nenkin funds transferred to your property country’s pension system, called totalization. If you have contributed for over 10 years, nevertheless, you can not obtain the lump sum benefits. Chances are you'll qualify for a Canadian or a Japanese benefit, or each. Nonetheless, beneath the Agreement, the benefit paid by each country will likely be based solely on your creditable durations underneath that country’s pension program. In other words, Canada will pay a benefit amount reflecting the portion of your durations which can be creditable beneath Canada's pension program, and Japan can pay a profit quantity reflecting the portion of your creditable periods below Japan's pension program. The Canadian pension applications included within the Settlement are the Canada Pension Plan and the Outdated Age Security program. If you don't qualify for a Canada Pension Plan benefit primarily based on your contributions to the CPP, Canada will consider periods of insurance under the pension program of Japan as periods of contribution to the Canada Pension Plan.

The nimblest, cleverest and the quickest-considering do. In cricket, one of the best batsmen haven't been massive men -- Bradman, Gavaskar and Tendulkar come to mind. Rod Laver, the best of the very best in tennis, was known as 'Pocket Rocket' in reference to his measurement, or the lack of it. Dinosaurs didn't survive the catastrophic asteroid influence sixty six million years ago; the survivors were mostly species weighing lower than 25 kilos. It's best, if potential, to enroll in auto withdrawal from your bank account each month, as these techniques typically supply a discount. It's also possible to pay advance contributions in lump sum form. What Advantages Come from The Japanese Pension System? Nenkin’s pension advantages differ relying on your intent and living scenario in Japan. Surya Kant, who has been on the helm of TCS North America and has spent forty three years at TCS, retires at the top of the fiscal year. IT major Tata Consultancy Providers (TCS) has made modifications to its management roles in North America. As a part of the adjustments Suresh Muthuswami has been elevated to the role of chairman, North America, mentioned sources in the know.

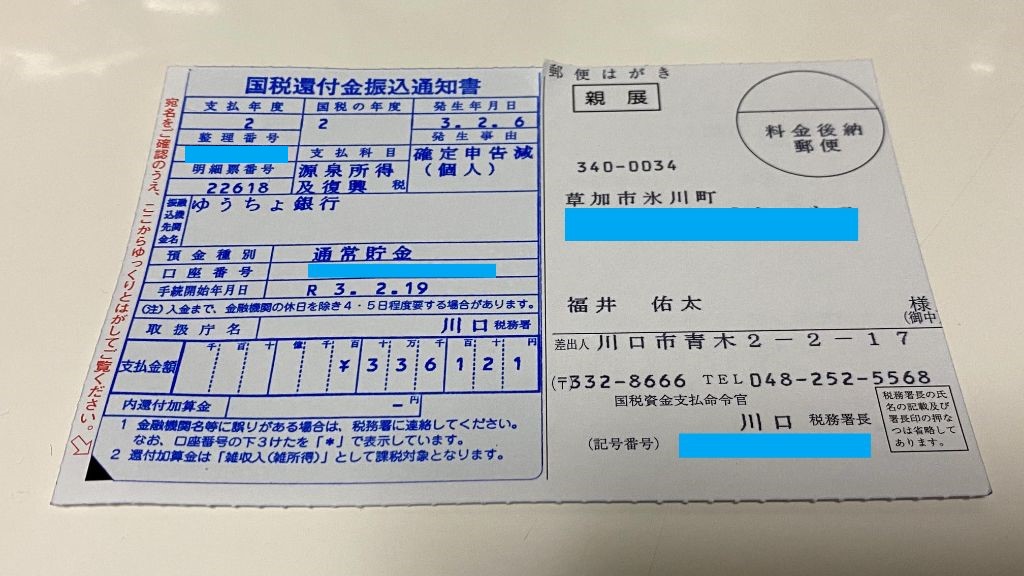

If we are talking about Japan Pension Refund For Foreigners then how do you are feeling once you contribute to a challenge and don’t get your hard-earned money again? After all, everyone seems to be upset when they lose their hard-earned cash. While some of us who work and reside in Japan could keep in Japan long-term, for many Foreigners, their experience in Japan only lasts a couple of years before moving to another country. A. For those who retire on April 1, 2004, and after, interest in your account stability will be paid in accordance with new earnings crediting guidelines that may comply with the statutory limits on Tier One common account crediting. Accumulated interest can be paid together with your last installment. Q11. May I remain in the variable account if I elect a lump-sum option? The Japanese system measures credits in months. For simplicity, the table reveals the requirements in years of credit. Reduced profit as early as age 62. Required work credit vary from one and one-half to 10 years (10 years if age 62 in 1991 or later). Worker—NP-Full retirement age is 65. Lowered benefits are payable as early as age 60. A minimum of 25 years of protection is required.

This is also why such teachers receive a Specialist in Humanities visa as a substitute of 1 as an instructor or professor. ALTs are in decidedly murkier waters on this regard, as regardless of being employed by personal dispatch corporations, they perform their duties in public colleges. 2, 日本年金機構 although some presently dispute this. In both case, you and your employer should still be contributing in some form to the pension plan on a month-to-month basis. Taxpayers who receive insurance coverage by means of an Trade can still face out-of-pocket medical expenses. In the case of Antilla-Brown v. Comm’r, Mrs. Antilla-Brown was a few years short of Medicare eligibility and obtained insurance coverage through an Trade. Mrs. Antilla-Brown was diagnosed with most cancers and confronted severe health points, resulting in hundreds of dollars in payments not lined by the Exchange’s insurance coverage. Subsequently, if a US person earns public pension from work performed in Japan, then they'll claim that it is only taxable in Japan. It doesn't apply to a US Citizen or Permanent Resident of the United States involving advantages from the United States. What does this Mean? Luckily in the instance of a US particular person residing in Japan and receiving benefits from a public pension in Japan — the saving clause exception may not limit the tax advantages. But, if that very same US person was receiving advantages from the United States under paragraphs 18 or 19 (Social Security), then it is just excepted when the person is neither a US Citizen nor Permanent Resident.

댓글목록

등록된 댓글이 없습니다.